Recently I have finished reading the book Rich Dad Poor Dad by Robert T. Kiyosaki. For someone who has never ventured into the personal finance and investment world, it is certainly an eye-opener. I learned a lot of new ways of thinking regarding money, but also kept critically thinking about the deeper issues beyond the sugar-coated words in the book. So here is my critique on the somewhat short book:

Assets vs Liabilities

What the book said

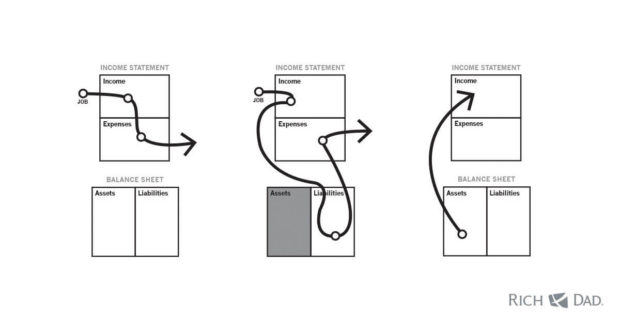

Rich people acquire assets. The poor and middle class acquire liabilities that they think are assets.

This is probably one of the biggest ideas in the book. I must admit that this concept changed how I see the world in a drastically different way. But first, I must define what is an asset and what is a liability. According to Robert:

An asset puts money in my pocket. A liability takes money out of my pocket.

So the idea is that rich people would buy assets, which in turn generates (passive) income for them. Whereas the poor and middle class would buy liabilities, which in turn takes more money out of their pocket.

One interesting thing to note here. The author phrased this as a behavior of the people who are currently rich or poor. However, he also implied, through many examples in the book, that this is the reason why some people become rich in the first place while the others don’t.

My take on “Assets vs Liabilities”

My take on this is that it opens up a different perspective on personal finance for me. For very long I have believed in pure meritocracy – Work for reward. Reward for work (thanks to the Singapore education system). I view money as primarily income, expense and savings, and never really considered the idea of an asset. The idea of using the money to generate more money was directly against what I see as a fair and meritocratic society.

This view has been shaken quite a bit by the time I finished the book. I still despise the nature of capitalism in the sense that it creates income inequality, but I do see why it is justifiable to a certain extent. The justification has to do with the concept of taxation and business, which I will touch on more below. Suffice to say, I recognize that investing in assets is a sensible thing to do with my income.

But there is a catch. The author seems to equate all forms of investments to assets and encourage people to buy stocks, bonds, real estate. However, by looking at the definition provided by the author himself and applying some common sense, this can be easily shown to be false. Price of stocks and bonds goes up and down, so do the real estate. There is no guarantee that these forms of investments would be assets. In fact, if you buy a stock that is losing value, it becomes a liability, much like – to borrow the author’s words – “electronic doodads”. On the flip side, if you just put your money in a savings account, you will get some kind of interest, no matter how little. And that, according to the author, is considered an asset.

So the concept of buying assets is good. The billion dollar question, when it comes to investing is how do you tell which is an asset and which is a liability.

Taxation and Business

What the book said

The book offered some interesting angles on the idea of tax and business (corporation). These are actually two separate topics, but I put them together because they are kind of related.

The idea is that taxation ultimately benefits the rich. When I first read this idea, I didn’t believe it. After all, the high-income group is taxed the highest percentage in general.

However, the author’s claim is that the rich have ways to avoid the tax, such as keeping the assets in investments and spending money via their business. People who don’t have investments or business would end up paying tax on 100% of their income and then spend the money, while the rich don’t pay tax on their investments until they liquidate them and spend the money via their business, using pre-taxed money. Hence, although the rich are taxed the most, the majority of their wealth is not subjected to tax, because they are either not in the form of income, or wrapped in a corporation and spent before the taxation.

My take on “Taxation and Business”

I do believe whole tax and business tactics are real. At least in Singapore, I can see how people are investing and expensing through their business. The question is: Are they ethical? And does it matter? The tax laws and business laws are there. As individuals, we can only follow them in most cases. Even if we did try to change it, would the rich be able to find alternative ways to preserve their wealth?

This got me thinking: Ultimately, who is suffering from these laws? The rich who try to use them to their advantage, or the poor who simply follow the pre-defined path as a normal worker or employee? If we can’t change how the world and other people work, what is the best course of action for an individual like me? We can turn to game theory for some answers.

Applying Game Theory to Getting Rich

Assuming the following:

- We cannot influence others’ behaviors

- There are people out there maximizing their own interests (the rich, the adversary opponents)

- There are finite resources and values that can be created and consumed

The logical consequence of such as a setup is close to a zero-sum game without coordination between the player. So the best course of action is just to maximize your own gains assuming the most adversary opponents (who are also maximizing their own gains). However, this theoretical plan on its own is flawed. What if everyone stops working and creating physical values and turn into investors or business owners (the most adversary opponents)?

- If we still act like the others, then collectively we create no value at all, and everyone dies (of hunger)

- If we change our strategy and be the value producer (farmer, or worker for example), and a small number of people follow us, then everyone else wins

From this experiment, we see that there is a hidden assumption about the real world that allows the rich to behave as they are: There will always be enough people who are the creators of physical values (farmers, workers), and not the most adversary opponents in terms of collecting capitals. Only then, this course of action would make sense. In other words, the poor enable the rich to become richer. A cruel way of looking at things, but hey, that’s capitalism in its purest form.

Sure this seems dire if you hate people becoming rich… but consider the fact that they are providing an invaluable commodity for the working class. Housing. And possibly very affordable housing. If I choose to invest my extra money into the construction of a small rental home… not only does it provide me an extra income but it provides jobs for homebuilders, utility workers, and it provides an affordable place to live for members of the working class.

Let’s say for example that a rare earth minerals mine is opening up in a small nearby town. My investment in real estate in that town is going to provide housing for workers at that mine, which in turn will result in the extraction of resources that can be used to produce goods. Without investments in housing, we would have no production. So we can either leave it up to the rich people to make all the money or rise to the occasion and invest our own capital.

You can’t look at the economy in an all or nothing lense because free market economics results in a natural balancing of production and natural resources based on demand. It’s way too complex to reduce economic decisions to “what if everyone did this or that”. If everyone suddenly chose to be a farmer producing food… we’d have way too much food and no labor left over for housing and transportation. It’s a pointless exercise.